Are retail businesses ready for the rise of e-wallets?

Currency is swiftly leaving its physical forms behind. Coins, paper notes— and now even cards— are slowly being replaced by digital e-wallet and payment technology.

READ NEXT

Are you already using a super-app?

For consumers, this means the convenience of not carrying bulky wallets. A smartphone could potentially take its place entirely. For businesses, on the other hand, the technology means no longer having to store and handle physical cash on-site.

The rise of e-wallets

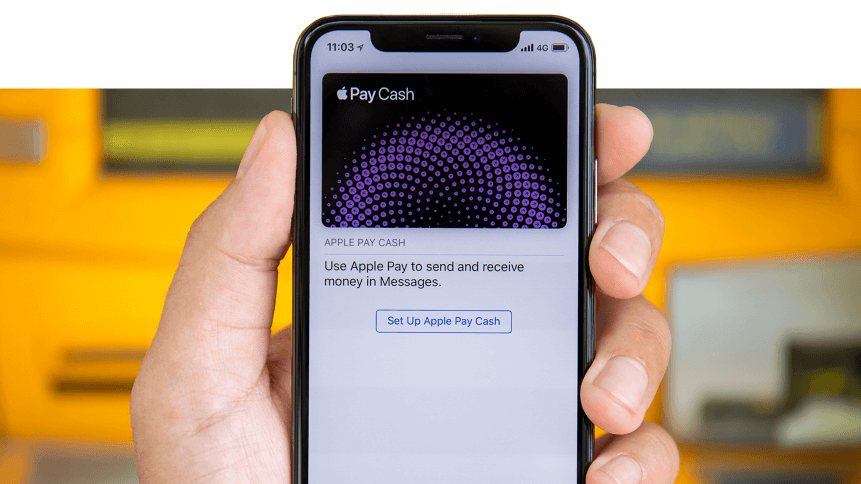

E-wallets are apps that allow users to either link their bank cards to enable payment services. Users can just tap NFC-enabled smartphones on a payment terminal at the counter to make a payment, while some services like mVisa use make use of QR codes.

Business Insider predicts that the number of in-store mobile payment users in the US will hit 150 million users by 2020— more than half of the States’ consumer population. Next year, 29 percent of Americans will be using mobile payments.

By 2021, meanwhile, Statista predicts payment by NFC or other contactless technologies (like QR pay) in the US are expected to meet US$190 million.

Noticing the growing need for digital payments, banks and other financial services companies are busy developing apps that enable their customers to use e-wallet services as they rapidly grow in popularity.

E-wallet apps themselves are now freely available on Google Playstore and Apple Appstore and there are tons for customers to choose from. Some come with value-added services; Paypal, for instance, allows users to invest their money into Paypal Acorns as a way to better manage their money, and donate to charitable causes directly from the app.

E-payments for businesses

Businesses that adopt e-payment methods benefit from the fact that they no longer need to count, store and handle physical cash.

This carries security benefits, but it also means organizations can avoid long, end-of-day book work, with e-payment systems able to generate a sales report each day with a few clicks. Some apps even have a business version that allows you to print statements, review transactions and detect cash flow from your phone.

What’s more, these apps are easy to set up. All customers need is either a payment terminal or a personalized QR code to enable the payment function. Registration is free and contactless terminals are available on a rental basis— businesses don’t need to fork out for expensive infrastructure.

Being an app that links cards digitally, however, there’s a natural concern when it comes to security. Some phones that are compromised by viruses could be prone to cyberattacks. When this happens, one would argue that the old way of using cash would be much safer than trusting an app to do the same.

Besides the risks of malicious attacks, being constantly connected to the internet, these systems are vulnerable to server downtimes and errors. Last year, for example, a “hardware failure” saw Visa’s network go down across the UK and Europe for five hours, which experts said would provide a “magnet” for ensuing scams.

Businesses using e-payment systems must also be content with sharing information about transactions— including amount, time and recipient with the payment system’s database. All of this information can be made available to authorities if required.

Striking a balance

The rise of e-wallets, if statistics are to be believed, is unstoppable, driven by their convenience and usability among consumers. As such, e-payment systems must be in place to accommodate this trend— a push-pull effect will drive adoption of these systems on both sides of the counter.

Businesses would be wise to begin adopting these technologies in preparation but, at least at present, they must be ready accept sacrifice to some anonymity and some cybersecurity risks for the benefit of convenience and customer satisfaction.