Don’t ‘wait and see’ for Industry 4.0, warns GlobalData

The fourth industrial revolution— or ‘Industry 4.0’— promises to transform traditional manufacturing by marrying operational technology with information technology.

Underpinned by the advanced use of data, new technologies and flexible automation, the Industry 4.0 movement drives towards enhanced human-machine interaction. Driven by disruptive technologies aimed at tackling inefficiencies, interconnectivity, information transparency and autonomous decision making are key goals of this change.

As this seachange takes hold, GlobalData’s Disruptive Tech Analyst, Kiran Raj, warns that manufacturers that are slow to adopt these changing technologies and mindsets risk falling behind competitors who are able to deliver “higher quality products at lower costs”.

Raj describes these organizations as building “cyber-physical production systems”, and while that sounds massively complicated, according to GlobalData, Industry 4.0 initiatives can be largely distilled down to the adoption of several core technologies.

In an analysis of its Disruptor Tech Database, the industry intelligence firm identified five crucial technologies in transforming industrial manufacturing: big data & analytics (BDA), Industrial Internet of Things (IIoT), additive manufacturing (3D printing) and augmented reality (AR).

Other more supplementary technologies, it said, included advanced robotics, digital twins, simulation, cybersecurity, artificial intelligence (AI) and blockchain.

On BDA, GlobalData said the technology plays a “remarkable role” in manufacturing.

Analyzing huge volumes of data coming from management systems and sensors fitted to production equipment means humans workers can distance themselves from machines and tiring and dangerous tasks, increasing safety as well as efficiency.

Anglo-Australian mining giant Rio Tinto, for example, was able to avoid unexpected break down of its vehicles using BDA, which are estimated to cost the company up to US$2 million.

Its autonomous hauling system has nearly 200 sensors producing more than 4TB of vehicle data per day including location, speed, and other real-time metrics, across the fleet of 900 vehicles.

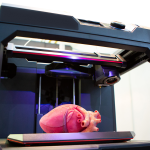

When it comes to 3D printing, meanwhile, the technology has opened up “phenomenal” production opportunities such as product prototyping and mass production of custom tooling.

YOU MIGHT LIKE

3D printing is finding its place in enterprise

GlobalData noted that Volkswagen became the first carmaker to employ 3d printing at large scale in the automotive industry. The technology named HP Metal Jet has been tested to increase productivity up to 50 times compared to the existing 3D printing methods based on the component.

“Industry 4.0 can empower building what many refer to as ‘smart factory’ for a truly productive environment with benefits to manufacturers as well as consumers such as enhanced communication, real-time monitoring, advanced data analysis and self-diagnosis,” said Raj.

The concept of a smart factory is flexibly automated and self-monitoring explains GlobalData. Machines, materials, and humans communicate with one another, sparing workers for other productive tasks, and ultimately making design and production processes more efficient.

The benefits are clear, but GlobalData warns that under the layers, there are critical challenges for manufacturers such as data management, upskilling employees and cyber incidents. However, these can be overcome and prevented with measures that don’t impact production.

“While incumbents, such as Bosch, GE, and Siemens, have been muscling to capture a sizeable share of Industry 4.0, many manufacturers are yet to consider serious investments,” Raj said.

“Given the benefits over threats, a wait and watch stance may risk their competitive position in the future of manufacturing.”